403b Maximums For 2024

403b Maximums For 2024. Starting in 2024, employees can contribute up to. The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that.

Elective contribution limits will increase by $500 to $23,000. On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2024.

In 2024, Employees Can Contribute Up To $23,000 Per Year To Their 403(B) Plan, Up From $22,500 In 2023.

If you have at least 15 years of service, you may be.

The 403B Contribution Limits For 2024 Are:

If you’re 50 or older, you can contribute an.

Contribution Limits For 403(B)S And Other Retirement Plans Can Change From Year To Year And Are Adjusted For Inflation.

Images References :

Source: jackelynwcate.pages.dev

Source: jackelynwcate.pages.dev

2024 403b Limit Jane Roanna, The maximum 403 (b) contribution refers to the highest amount that an individual can contribute to their 403 (b) retirement plan in a given tax year. Wed, february 21, 2024, 7:00 am est · 5 min read.

Source: winnyqstephana.pages.dev

Source: winnyqstephana.pages.dev

403b 2024 Limits Aeriel Charita, The extra $500 amounts to about. In 2024, employees can contribute up to $23,000 per year to their 403(b) plan, up from $22,500 in 2023.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, Elective contribution limits will increase by $500 to $23,000. 403 (b) max contribution is flexible.

Source: 401kspecialistmag.com

Source: 401kspecialistmag.com

Expanding the Reach of Your Practice with 403(b) Plans, You can tuck quite a bit away into your 403 (b) plan, but the irs does set limits to how. Wed, february 21, 2024, 7:00 am est · 5 min read.

Source: www.portebrown.com

Source: www.portebrown.com

New 2022 IRS Retirement Plan Limits Announced, On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2024. Employees can reach this limit by contributing about.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

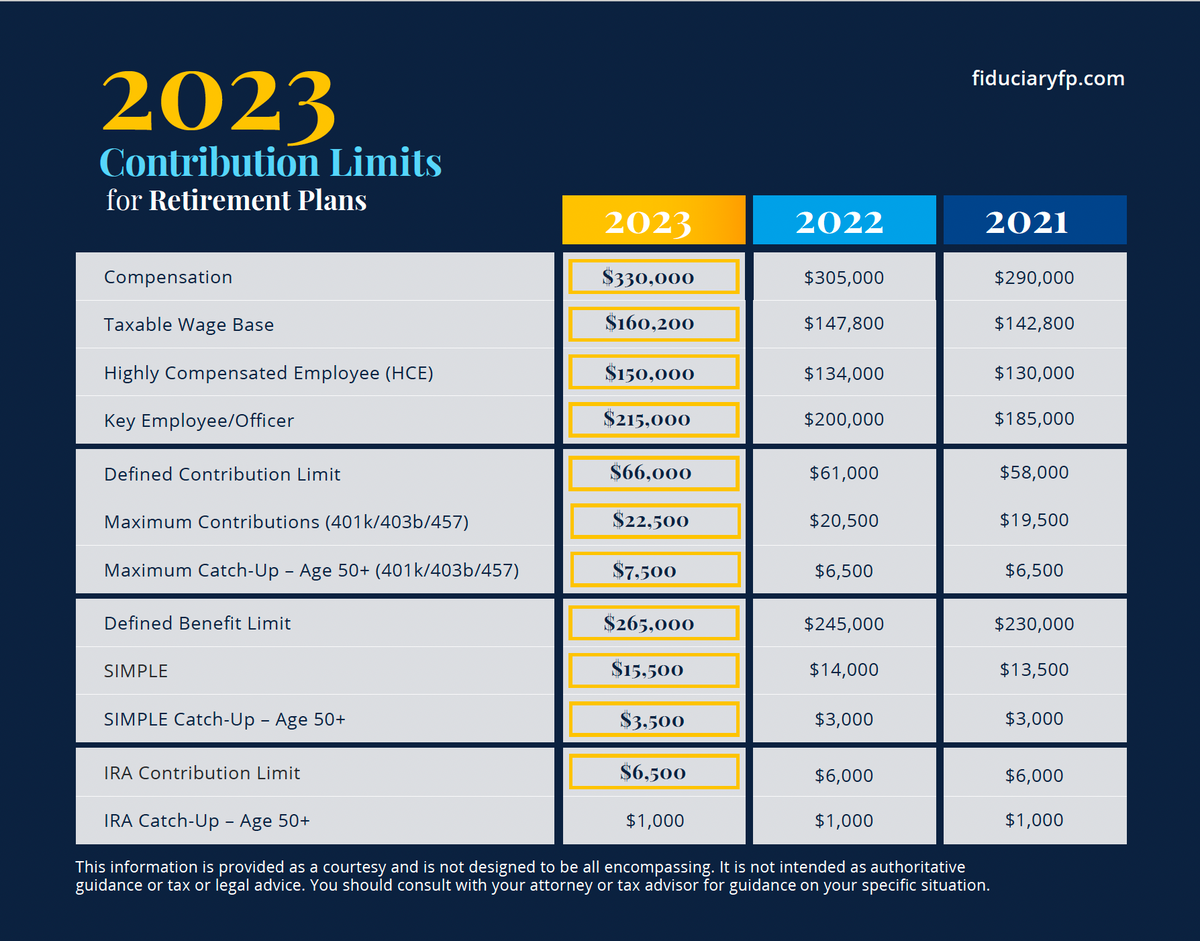

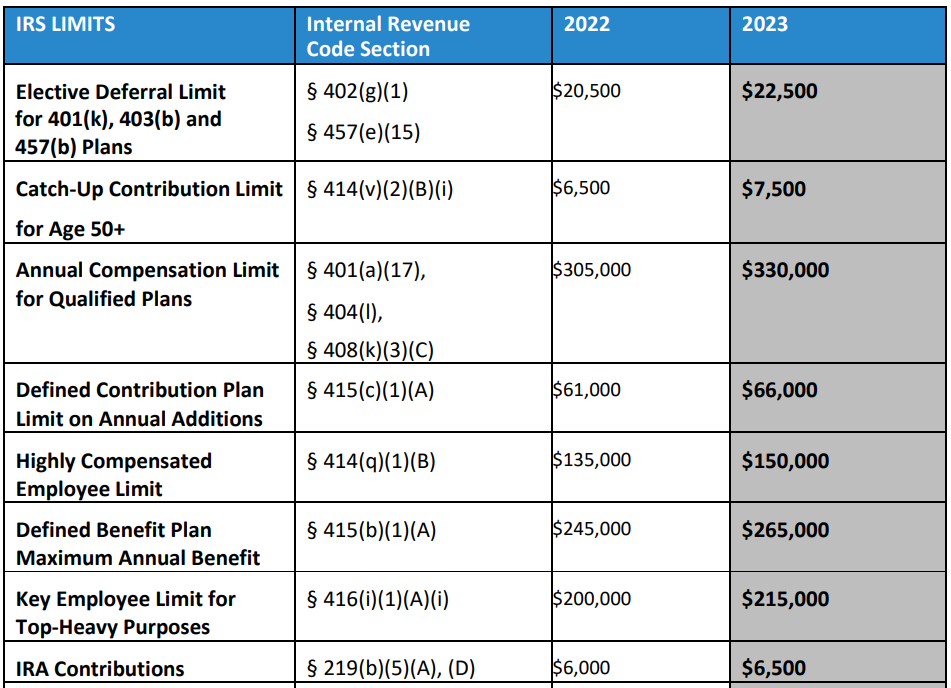

403(b) Contribution Limits For 2023 And 2024, The contribution limit for 403 (b) plans is $23,000 in 2024 for workers under age 50, up $500 from $22,500 in 2023. 403 (b) max contribution for 2024.

Source: olenkawbabbie.pages.dev

Source: olenkawbabbie.pages.dev

2024 Tax Limits Hayley Auberta, Wed, february 21, 2024, 7:00 am est · 5 min read. 403(b) contribution limits in 2023 and 2024.

Source: www.annuityexpertadvice.com

Source: www.annuityexpertadvice.com

403b Calculator Calculate Your Retirement Savings (2024), The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that. 403 (b) max contribution is flexible.

Source: www.lexology.com

Source: www.lexology.com

What Are the Retirement Plan Dollar Limits for 2023? Lexology, The elective deferral limit for employees who participate in 401 (k), 403 (b), most 457 plans, and the federal government's thrift savings plan increases from. If you exceed this contribution limit, the irs will tax your funds twice.

Source: livvyqlynelle.pages.dev

Source: livvyqlynelle.pages.dev

Hsa Limits 2024 Rycca Clemence, If you're over 50, you can save $30,500 per year, or a. Even if you only save a small percent of your income, take.

Elective Contribution Limits Will Increase By $500 To $23,000.

In 2024, you can contribute up to $23,000 to a 403 (b).

This Means That For Savers Under 50, You Can Defer $23,000 Per Year, Or A Total Combined $69,000.

403 (b) max contribution for 2024.